- Home

- Product

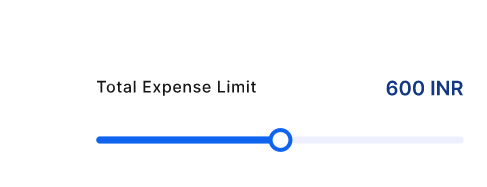

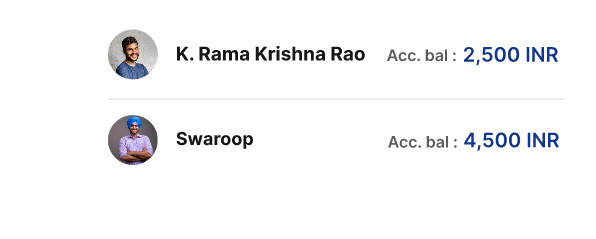

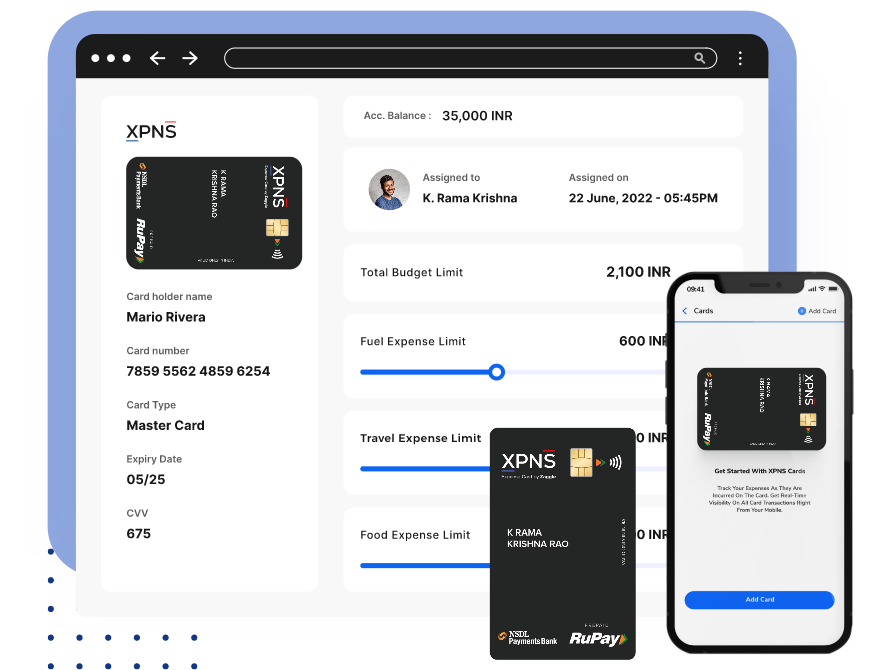

Integrated Prepaid Cards

Greater visibility and control over employee expense as it happens

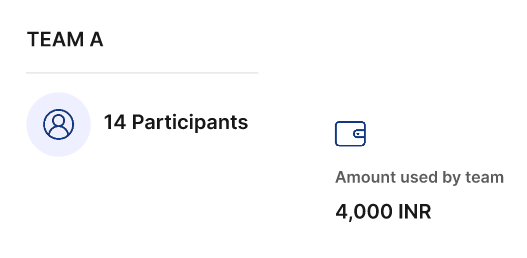

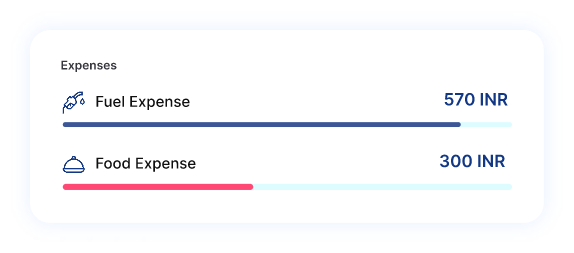

Policy Controller

Proactively define expense guidelines so employees stay compliant and on budget

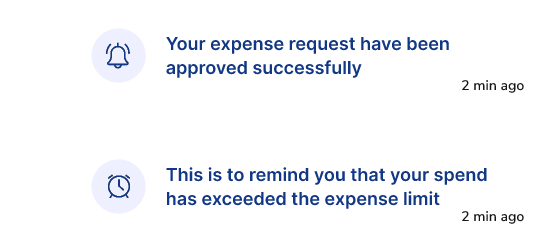

Touchless Approval Flows

Orchestrate multi-level approval workflows tailored to specific business needs

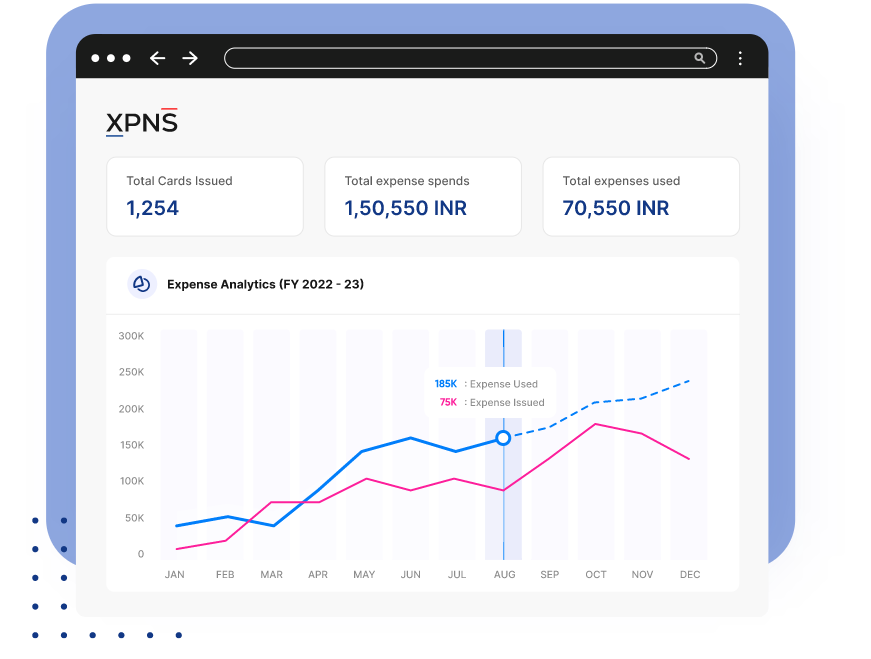

Rich Analytics

360-degree view of expense optimises cash flow, reduces fraud and improves operating efficiency

- Pricing

- Partner

- About Us

- Knowledge Hub

Resource Centre

Fuel your growth with comprehensive product resources

FAQ

Frequently asked questions and the answers to them

Newsroom

Get the latest press updates on XPNS.

Media Buzz

Creating headlines in the expense automation space

Blogs

Our point of view on trends pertaining to products, technology and industry

- Contact Us

- Home

- Product

Integrated Prepaid Cards

Greater visibility and control over employee expense as it happens

Policy Controller

Proactively define expense guidelines so employees stay compliant and on budget

Touchless Approval Flows

Orchestrate multi-level approval workflows tailored to specific business needs

Rich Analytics

360-degree view of expense optimises cash flow, reduces fraud and improves operating efficiency

- Pricing

- Partner

- About Us

- Knowledge Hub

Resource Centre

Fuel your growth with comprehensive product resources

FAQ

Frequently asked questions and the answers to them

Newsroom

Get the latest press updates on XPNS.

Media Buzz

Creating headlines in the expense automation space

Blogs

Our point of view on trends pertaining to products, technology and industry

- Contact Us